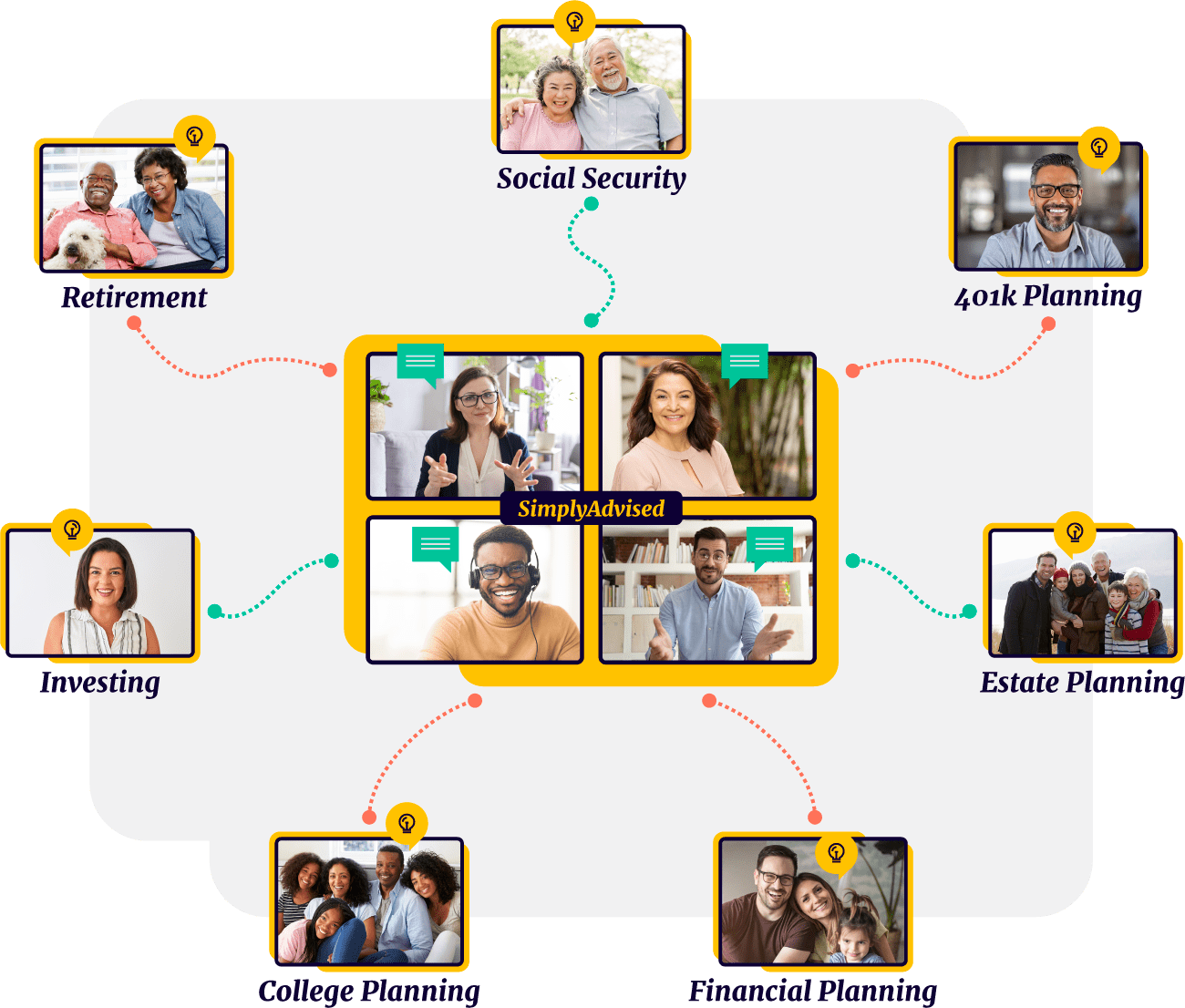

Education from Trusted Professionals

When life events create the need for financial education, SimplyAdvised connects you to trusted sources.

Helping you achieve your financial goals through reliable guidance from established experts and information rich resources.

How SimplyAdvised Works

Getting started with SimplyAdvised is simple, free and there is zero obligation.

Whether you are just getting started in your financial journey, preparing for retirement or anywhere in-between. SimplyAdvised is here to help by matching you with trusted and timely financial education and resources aimed at helping you secure your financial future.

Why SimplyAdvised?

Trust and Transparency

We provide you with trusted and vetted information to help you achieve your financial goals.

Our Mission

To help guide you to make informed decisions regarding your financial goals through finding an advisor and educational resources.

Confidential

Any information you provide us is completely confidential. We do not sell or share this information.

Zero Cost. Ever.

Our educational resources are of no cost to you. We’re here to help you navigate any financial situation and make the best decision for you and your family.

SimplyAdvised Podcast

Your go-to place to find trusted subject-matter experts who communicate critical information in a meaningful and memorable way, guiding you to make smart choices.

Episode 4: The IRA Exit Strategy BluePrint – with Brad Gotto

Episode 3: Your Ultimate Guide To the Bucket Strategy — With Mason Gorris

Episode 2: The Advantage of Roths In Your Portfolio — With Kelly Boyd

SimplyAdvised Blog

Quick and easy-to-read information regarding retirement strategies, estate planning, taxes, Social Security and more.

Six End-Of-Year Tax Tips

While we may be approaching the end of the year, there is still time to trim your tax bill for next year. Whether you had a year full of financial gain, suffered financial losses or rode the middle ground all year, you can still make moves to put yourself in a better...

Six Common FAFSA Mistakes to Avoid

Billions of dollars of federal aid is given out to students across the country every year. The only way for your student to receive any of this money is by filling out the Free Application for Federal Student Aid, also known as FAFSA. Schools use the information they...

College Scholarships and Grants: What You Need to Know

Figuring out how to finance higher education for your child or children can be a daunting task. While there are many options to explore, looking into scholarships and grants (also known as gift aid) is a great place to start. Unlike student loans, scholarships and...